Market Design

- What is Hedging?

- So why are the EU and the Irish Government intervening in the market?

- So, what is the other stuff electricity customers pay for?

- Is this not a problem with the electricity market then?

Supplier Interventions

- What are Electricity Suppliers doing to protect customers?

- How are Suppliers Tackling High Prices?

- How are Suppliers Preventing Disconnections?

High Prices

What is Hedging?

Wholesale price is not immediately reflected in customer price; indeed wholesale price changes every 30 min and can show huge variation depending on the time of the day (peak (5pm-7pm) versus non-peak (2am-4am). Customers therefore received a blended price that takes account of the daily, weekly and monthly fluctuations in price, the cost of generation and the financing of these costs.

These financing costs include the costs to buy electricity and gas in advance on long-term contracts at fixed prices in order to try and avoid the volatility of prices. This is called hedging into the future, and it helps maintain steady prices for consumers if there are external shocks in the wholesale market. When the prices dramatically rose in 2021, consumers were protected from the worst of the sharp price increases as it took some time for them to feed into higher costs for customers. For example, while gas prices in that period rose by 1500% the wholesale cost of electricity rose by 300%[1]. Likewise, now that prices have lowered, there is a lag before customers will feel the effects. Suppliers are locked into higher prices due to hedged positions negotiated during a period of high prices sometimes 1-2 years previously. The overall effect of hedging is a smoothing out the highs and lows of price volatility to yield a more stable price for customers.

Back to Index

So why are the EU and the Irish Government intervening in the market?

The EU Council Regulation on an emergency intervention to address high prices (2022/1854) was agreed on the 6th of October. At a high-level the EU wants to decouple final electricity prices from gas prices. They have recognised that this is an exceptional short-term option to temper price spikes by collective European action to ensure security of supply at reasonable prices for next winter and beyond. The Council Regulation includes:

- a temporary solidarity contribution based on taxable profits for fossil fuel production and oil refining.

- a cap on market revenues of for specific technologies in the electricity sector,

and these measures were introduced in Ireland on the 1st of December, The new revenue cap being implemented by DECC focuses on trying to capture the excess rents achieved by low-cost renewable units that get the high price set by the gas-fired plant and use them for energy supports for customers.

The price of electricity sold will be based on a monthly average of a blend of prices and has set the level of the cap at €120/MWh for wind and solar and €180/MWh for all other technologies. The estimated revenue will be used to insulate business and households from the adverse effects on energy price inflation. The expected timeframe for Irish legislation is for Q2 2023.

However, given the urgent need for Investment in the energy transition, where electricity market participants will be the primary investor, these market interventions need to be time limited and take into account the high degree of hedging that occurs in the renewable sector.

Back to Index

What are Electricity Suppliers doing to protect customers?

Electricity and gas suppliers in Ireland have a lot of experience in dealing with Customers who are in financial hardship. During the last Recession when domestic disconnections were running about 14,508/year in 2011[1] they collaborated to develop the Energy Engage Code that committed to never disconnect a customer that engages with them. Since then the number of disconnections has fallen to 648 in 2021[2] . Similarly, since the beginning of this crisis suppliers have worked proactively to prevent disconnections and debt.

Throughout this volatile period the number of customers has remained steady[3] with arrears for domestic customers at 10% in Q2 2022 compared with 11% in Q1 2019.

Customer protection in the energy sector is always a high priority, the energy crisis affirmed that consumer welfare is the chief concern when creating policy. Electricity suppliers have Implemented a suite of emergency Government interventions as well as their own initiatives. The suite of interventions was achieved swiftly due to the established systems for introducing customer protections, as well as coordination between industry, the DECC (Department of Environment Climate and Communications), Revenue and the SEAI (Sustainable Energy Authority of Ireland). This is a summary of what has been achieved this winter so far.

[1] https://www.cru.ie/wp-content/uploads/2011/07/cer12014.pdf

[2] https://www.cru.ie/wp-content/uploads/2022/10/CRU2022973-Arrears-and-NPA-disconnection-update-H1-2022.pdf

[3] IBID.

Back to Index

How are Suppliers Tackling High Prices?

- Energy suppliers issued the Government €600 credit to all customers in three tranches to help with bills – first tranche in November. This has significantly reduced the burden of the high prices currently being felt.

- Working with the SEAI and Government departments, suppliers assisted in implementing the Temporary Business Energy Support Scheme, allowing businesses to receive up to 40% of the difference in the price of their bills from this time last year (provided their unit price increased by 150%).

- In a bid to assist customers in repaying high bills, suppliers have extended the timeline to 24 months for repayment.

- As of October 1st, 2022: Where a PAYG meter or budget controller is, or will be, installed for a customer who has outstanding debt, suppliers must ensure that up to a maximum of 10% of a single customer vend can be attributed to debt recovery. This is to apply to all domestic PAYG customers. This is a reduction of 15% in the debt recovery per vend.

- As of December 1st, 2022: Suppliers were required to ensure that all customers with a financial hardship meter are automatically placed on the most economic tariff. This includes a tariff that might otherwise only be available to, for example, a new customer or a customer as a retention offer. The customer in financial hardship must be placed on whichever tariff is the cheapest.

- Supporting these measures, suppliers have also established hardship funds which seek to support customers who are struggling with paying their energy bills. Opting to forego profit in order to assist customers that are struggling, committing to assist those most in need without Government intervention and blanket measures.

Back to Index

So, what is the other stuff electricity customers pay for?

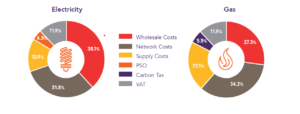

According to the CRU[1] as of June 2020, wholesale and network costs comprise circa 70% of electricity bills, with the remainder divided between supply costs, the PSO levy and VAT. For gas, wholesale and network account for circa 62% of the bills, with the remainder consisting of supply costs, the carbon tax, and VAT.

[1] CRU20125 Factsheet Domestic electricity and Gas bills in Ireland

Back to Index

How are Suppliers Preventing Disconnections?

- Even prior to the current crises, suppliers never disconnect an engaged customer under the Energy Engage Code. Encouraging customer who are struggling to contact their support teams and ensure that debt is being actively managed.

- The Christmas moratorium on disconnections for all domestic customers (for non-payment of account) is from 1 December 2022 – 28 February 2023. Whilst there is always a moratorium on disconnections around Christmas in Ireland, this moratorium was extended significantly longer than usual to encompass the higher energy bills expected around the winter months.

- Regarding Pre Payment meters, which self-disconnect at €0 credit, there was the introduction of €20 emergency credit. Having looked at other options, extending the emergency credit was the scenario of best fit in reducing the risk of customers amassing debt as well as mitigating the risk of customers disengaging.

- A moratorium on disconnections of pre-payment meters is not feasible due to the meter capabilities.

- Medically vulnerable customers are flagged with ESB Networks to ensure that these customers are never disconnected without an agreement between the customer and the supplier.

Back to Index

Is this not a problem with the electricity market then?

No, the electricity market, which is based on a merit order and marginal pricing system has been designed to European standards and has unlocked major benefits for consumers. The market design is based on the principal that the highest cost generating unit that gets selected (dispatched) to meet demand sets the price for all the other cheaper units that are also dispatched. This high-cost unit is generally a gas plant with high marginal costs.

In 2021 alone, ACER (the European Union Agency for the Cooperation of Energy Regulators) estimated the benefits of cross-border trading to amount to 34 billion euros due to increased dispatch efficiency. It is worth noting that more than a third of these benefits were delivered in the last quarter where energy prices were highest. They also found that the current market design significantly reduces short-term market volatility and estimated that the price volatility would have been around seven times higher in 2021 if national markets had been isolated.

This is a competitive market and prices go down as well as up. In 2020[1] the Commission for the Regulation of Utilities reported that gas generation in Ireland posted a net margin loss of

–6% and that the average cost per MWh of electricity sold was steady at €77/MWh in FY2020, not changing significantly from FY2019 (see appendix 1).

The EU Commission also had asked ACER to complete a review of the Electricity Market and they concluded their work[2] in May 2022 indicating that:

- whilst the current electricity market design is worth keeping, some improvements will prove key for it to deliver on important challenges, including:

- Making short-term electricity markets work better everywhere

- Driving the energy transition through efficient long-term market

- Increasing the flexibility of the electricity system

[1] https://www.semcommittee.com/sites/semc/files/media-files/SEM-22-021%20Generator%20Financial%20Performance%20for%20FY2020%20Report.pdf

[2] https://www.acer.europa.eu/events-and-engagement/news/press-release-acer-publishes-its-final-assessment-eu-wholesale#:~:text=Overall%2C%20ACER%20finds%20that%20whilst,through%20efficient%20long%2Dterm%20markets

Back to Index

Why Do Gas Prices Effect Electricity Prices?

Electricity prices are linked to gas prices as gas fuel represents 69% of a gas generators input costs and also 46% of Ireland’s electricity demand in 2021 was met by gas fired generators.

Back to Index