Eurelectric launched the 2021 Power Barometer on September 29th with a live webinar showcasing the emissions reductions that have taken place in the sector over the last 30 years and highlighting the role for all technologies in the power mix for 2030. The report sets out the remaining challenges to decarbonise Europe’s power sector and the barriers inhibiting Europe’s progress in adding more renewable capacity. Eurelectric recommends a series of policy actions which need to be prioritised if Europe is to meet targets set out in the Commission’s ‘Fit for 55’ package.

European Power Barometer 2021

-

-

-

-

-

-

- Remove barriers for renewables deployment: facilitate permitting

- Establish predictable, long-term market-based investment frameworks for all technologies

- Ensure necessary investment in grid infrastructure by modernising tariffs and ensuring access to EU funds

- Implement network codes quickly to achieve a Pan-European electricity market model

- Establish a comprehensive regulatory framework for flexibility solutions

- Boost deployment of public (fast)charging points for electric vehicles along TEN-T networks and in urban areas

- Accelerate electrification in buildings, transport and industry

- Reduce taxes & levies on electricity

- Ensure proper functioning of the ETS by avoiding national measures that jeopardise its final objective

-

-

-

-

-

Łukasz Koliński, from DG ENER, spoke to the challenges ahead in terms of energy system integration, underlining that electrification is the best route forward. When asked about the recent increase in power prices across Europe, he said the Commission would soon publish a toolbox of short-term measures Member States could adopt to help vulnerable consumers but that the long-term solution remains: accelerated deployment of renewables and energy efficiency improvements. On barriers to permitting procedures, he said this is a priority of the commission and guidance will be issued on streamlining procedures next year.

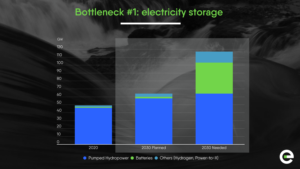

The report highlights the ambition gap of ~53 GW between planned storage and the amount of storage required for a low-carbon electricity system. The Power Barometer estimates Europe’s storage volume will need to more than double by 2030 compared to 2020, with the majority of that increase estimated to come from batteries. In Ireland, we know we will need more than a ten-fold increase in battery storage over this decade.

As the scale of investment in generation needed (€75bn pa) is more than double that of the last decade, Kristian Ruby, Eurelectric’s Secretary General, emphasised the need for governments not to interfere with a market-based framework which needs long-term price signals and de-risking mechanisms. Historically, most investments in the EU power sector have been supported by long-term contracts and in the next decade only a small share are expected to be fully exposed to spot and forward markets.

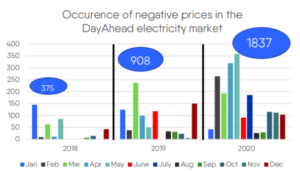

The report highlights the need for flexibility in the power system to be appropriately valued and the need for grid reinforcement. Europe had twice the amount of negative price hours in 2020 than in 2019, due to lower consumption as a result of Covid-19 restrictions and the rising share of renewables. The Netherlands was used as an example, going from 3 negative price hours in 2019 to 100 in 2020 due to solar capacity additions. Ireland maintained one of the highest amounts of negative pricing hours in 2020 at 382.

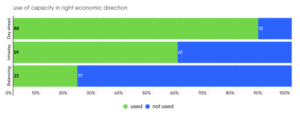

The inefficient use of interconnectors, particularly in intraday and balancing markets was flagged as well as a lack of coordination in cross-border capacity calculation and allocation.

The role of the distribution grid in decarbonisation was highlighted as it is estimated that distributed renewable generation will account for 70% of installed capacity additions (~43% in Ireland). The main messages from Eurelectric’s Connecting the Dots report were reiterated – significant investment over the next decade is needed to modernise, digitalise, expand and improve the resiliency of Europe’s distribution grids to harness the potential of distributed renewable generation, develop flexibility services and enable demand participation.

Eurelectric call for an urgent increase in the pace of electrification and highlight the gap between the European Commission’s projections for electricity demand and Eurelectric’s own decarbonisation scenarios.

For industrial processes, electrification using established technologies is 34% today and its estimated that this could be increased to 76% and reduce emissions in hard-to-abate sectors by 43%.

For transport, Eurelectric points to the current low share of EVs in car, bus, truck and van fleets as a concern and also concerning, despite the low share of Evs overall, is that EV adoption is growing faster than charge-point installations. In 2020, Europe had ~224k charging stations – more than 3.5m will be needed by 2030 according to Eurelectric’s estimates.

For heating, Eurelectric states the EC ambition for decarbonisation requires renewable energy from heat pumps to triple.